Editors Note: What great acquisition to compliment the Alimak Hek product line. Alimak Hek Industrial Elevators, Construction Hoists, Transport Platforms, Material Hoists and Work Platforms lifting solutions can construct building while building maintenance products from CoxGom and Manntech can maintain buildings after construction is complete.

___________________________________________

Alimak Hek, the vertical access solution company, acquires the leading global BMU (Building Maintenance Unit) provider Facade Access Group for an enterprise value of 120 MAUD (approximately 819 MSEK).

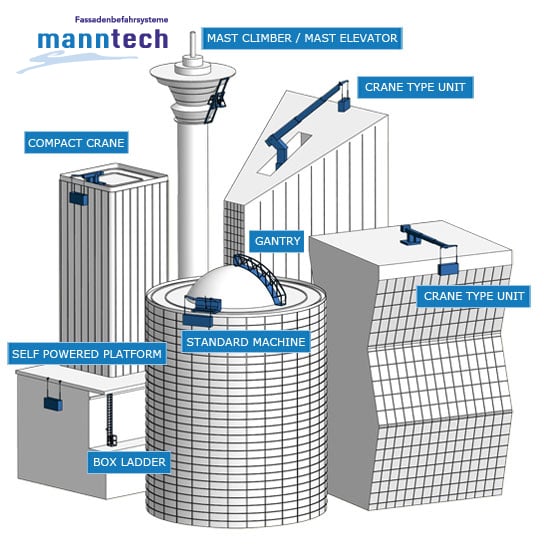

Facade Access Group has a global market leading position in permanent Building Maintenance Units, BMU solutions, based on high safety standards and with a long lifecycle. The company addresses the market via two brands; CoxGomyl and Manntech. Through this acquisition Alimak Hek strengthens and broadens the product portfolio, expands the existing footprint and business into a global adjacent niche market within vertical access while benefitting from a healthy underlying growth in the BMU-market.

“The complimentary combination of the two companies, especially when between the permanent installed solutions of Facade Access Group to Alimak Hek’s Industrial Equipment, will enable scale and synergistic advantages in the supply chain, expand overall business opportunity, including further development of the aftersales offering. Hence, I see the acquisition as a strong strategic fit and I am convinced that it will generate value to our shareholders”, says Tormod Gunleiksrud, CEO of Alimak Hek Group.

The transaction is subject to customary regulatory approvals and expected to close before year end 2016. After closing the acquisition is expected to be immediately accretive to EPS and contribute positively to cash flow while the Group’s EBIT margin is expected to be diluted.

The transaction is subject to customary regulatory approvals and expected to close before year end 2016. After closing the acquisition is expected to be immediately accretive to EPS and contribute positively to cash flow while the Group’s EBIT margin is expected to be diluted.

Alimak Hek Group acquires Facade Access Group for an enterprise value of 120 MAUD (approximately 819 MSEK) which corresponds to an EV/EBITDA of 7.7x and EV/EBIT of 9.2x as of June 30, 2016. The acquisition is funded by expanding existing credit facilities. Upon completion Alimak Hek will maintain a solid capital structure, with an expected leverage (net debt/EBITDA), of about 2.1x being well in line with the strategic target. Integration costs are estimated to ~65 MSEK.

Alimak Hek was advised by Lazard and Kirkland & Ellis. Due to effects on volume and earnings from the acquisition, Alimak Hek will come back with an update of the financial targets at closing.